I’ve looked at hundreds of small SaaS products for sale on marketplaces like acquire.com, littleexits.com, and other indie maker sites.

Most sellers will value their SaaS based on a revenue multiple that doesn’t make sense for the size of project they are selling. Here’s how I think about buying small recurring revenue products.

* I am not an expert and this is not financial advice.

The Truth About The Risk Of Micro-SaaS Revenue

Buying a micro-saas is risky. You are buying a product without

- Product-market fit

- High levels of competition

- No established long term metrics like LTV or CAC

So you can’t use similar buying criteria if you were looking at something with millions of dollars in recurring revenue.

What I want to see in a micro-saas is a single marketing channel that is working (because you can scale it).

If the customers are coming from multiple different channels (SEO, Paid Ads, Referral, etc) then it tells me there isn’t a clear way to buy it – improve it and ensure results.

When Will You Break Even?

Business 101 – what is your exit strategy?

You need to set a window for when you will call the project a success or exit it. Too many entrepreneurs hold onto a project for too long and burn out. For me it’s 6 months. If I can make acquisition costs back in 6 months it tells me I did something wrong and should move on.

Dead Simple Micro-SaaS Offer Calculator

Coming from my experience of underwriting real estate deals – you should create a simple model to analyze a deal and then use a much more sophisticated if you want to go deeper with due diligence. The idea behind a simple version is a quick yes/no gauge on digging into the metrics deeper and what price you could offer to make sure it’s worth the seller’s time.

How To Use The Micro SaaS Offer Calculator

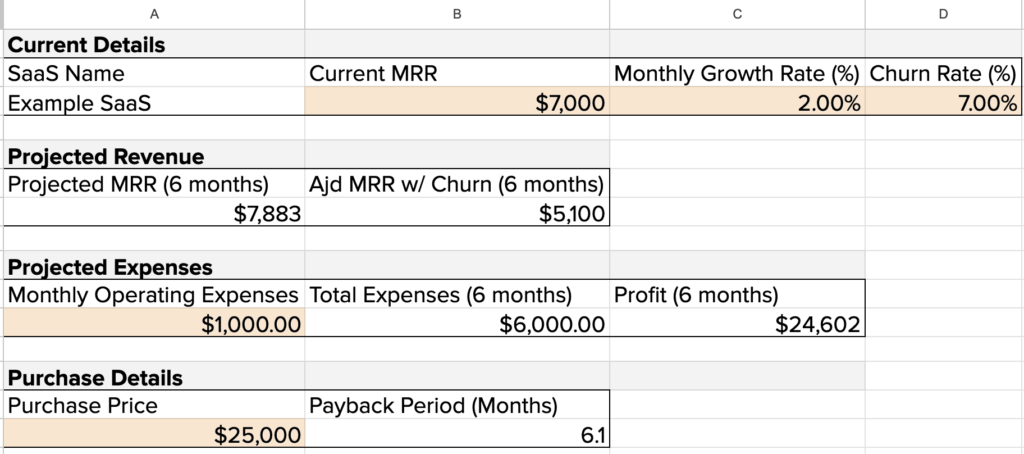

The orange cells are for inputs. Plug in the SaaS product’s metrics that you are evaluating.

Current Details

We are looking at current MRR, monthly growth rate, and churn

I want to see monthly growth rate because often times SaaS products will come out of the gates swinging with a big launch or promotion (think producthunt) and slow down over time.

If you are calculating growth based on YoY you could be missing some big seasonality swings or lack of marketing which will skew your profitability later on.

Projected Revenue

With our current details set – we will look at what the potential of revenue is over the next 6 months (our investment window).

We will account for churn to make sure we can always be profitable after looking at our expenses.

Projected Expenses

How much will this investment cost us to maintain?

You might find some leverage here. Perhaps the current business owner is paying for tools or services you could do without – already pay for with a different project or something similar. But if there is room to cut expenses you can deduct those later.

Analyze the deal as it stands – if you can cut costs that will just make your 6 month window easier to hit.

Purchase Details

With the inputs above set – you can now play around with an offer number that satisfies the 6 month payback period.

Final Thoughts

This works well for SaaS companies in the $1k-$10k range. If you are looking to analyze a deal that is much larger $100k of MRR or more…then you need a more sophisticated model to look at LTV, CAC, Net Revenue Retention, etc.

This is especially true if there is more than one revenue stream (recurring, one-time, usage based, etc).

Each of those types of revenue should be viewed and projected differently.

Last thought, in the above model if 6 months is too short/long for you and your buying criteria. Just adjust the calculations in the cells to be whatever you are comfortable with. There is no right or wrong answer.

Join The Newsletter

Get occasional emails from me when I publish new projects and articles.